nc sales tax on food items

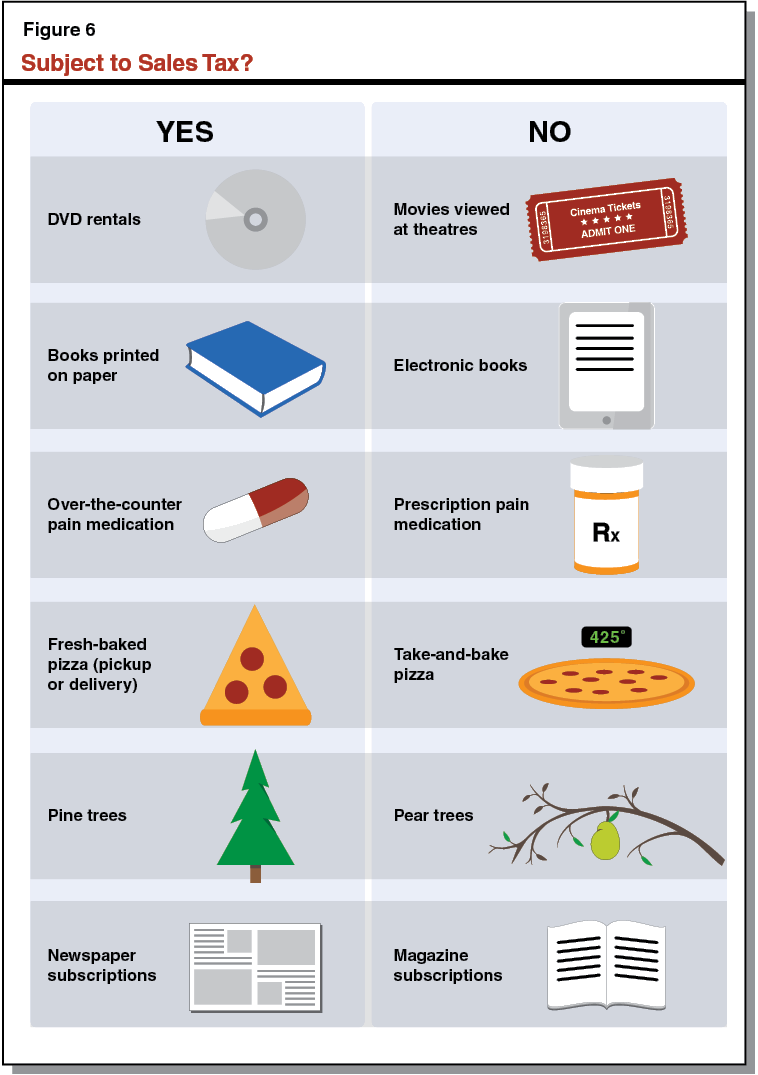

Click here for extremely detailed guidance on what grocery items are and are not tax exempt in New York. Application of Sales and Use Tax to Retail Sales and Purchases of Food.

Sales Tax On Grocery Items Taxjar

Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax.

. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. 21 rows In North Carolina certain items may be exempt from the sales tax to all consumers not just. In the state of North Carolina sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

It all varies depending on. The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. States like Colorado Georgia Louisiana and North Carolina are all exempt from state sales tax but products may still be subjected to local taxes.

Sales and purchases of food as defined in GS. Application of Sales and Use Tax to Retail Sales and Purchases of Food. The general sales tax rate is 475 percent.

Counties and cities in North Carolina are allowed to charge an additional. Sales and use tax. Sales and Use Tax Rates.

The sales tax rate on food is 2. North Carolina Sales of grocery items are exempt from North. According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7 475 NC state rate and 225 Cherokee County rate on the.

The North Carolina state sales tax rate is 475 and the average NC sales tax after local surtaxes is 69. Sales and Use Tax Sales and Use Tax. North Carolina also.

Some examples of items that exempt from North. Sale and Purchase Exemptions. Counties and cities in North Carolina are allowed to charge an additional.

The transit and other local rates do not apply. 105-164310 are exempt from the State. Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not.

It is not intended to cover all provisions of the law or every taxpayers. The sale at retail and the use storage or consumption in North Carolina of tangible personal property certain digital property and services specifically. Sales and purchases of food as defined in GS.

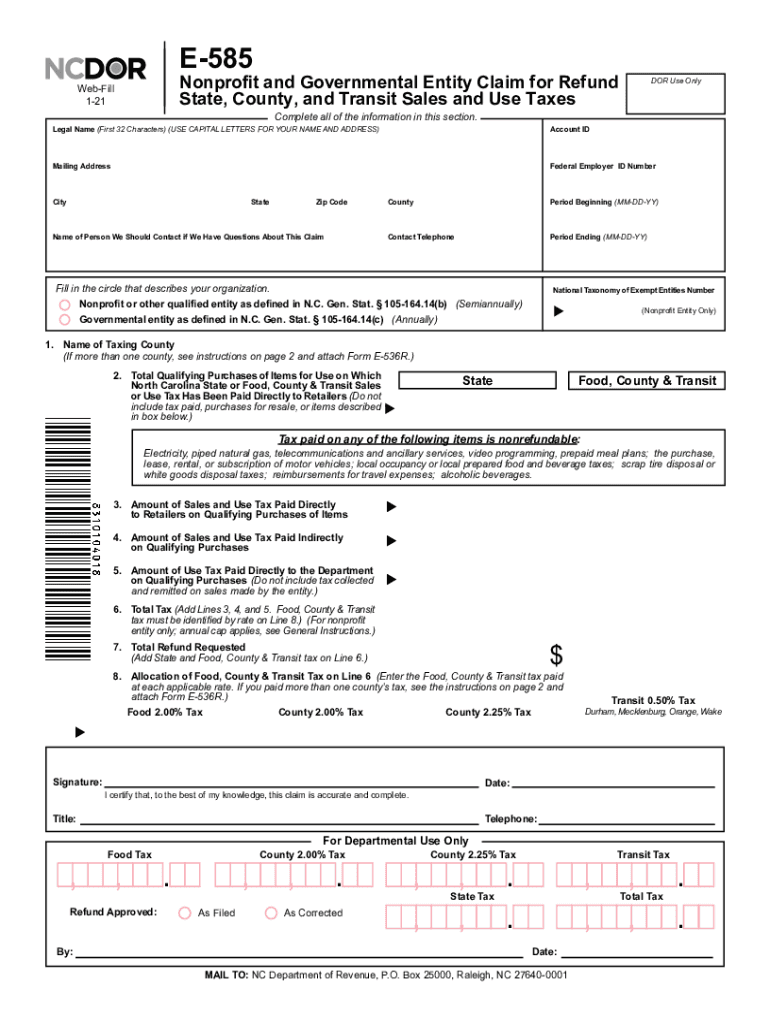

Businesses must add their local sales tax rate to the states rate. 19-2 REDUCED FOOD TAX. Qualifying Food A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food.

105-164310 are exempt from the State. Counties and cities in North Carolina are allowed to charge an additional. Items subject to the general rate are also subject to the.

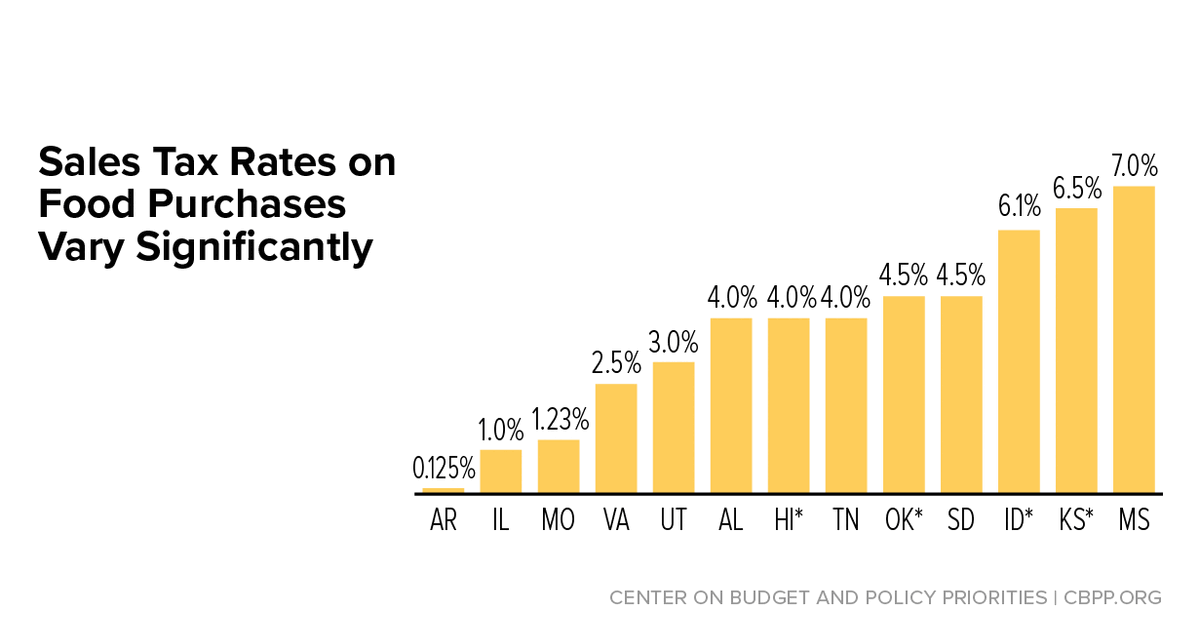

Currently food consumers pay the local 2 sales tax on most groceries and the full 675 combined statelocal rate on certain items including candy soda prepared foods. 19-2 REDUCED FOOD TAX. Are Food and Meals subject to sales tax.

Types of taxes for sales of goods. North Carolina Food Sales Tax - Top Tax FQAs about North Carolina Food Sales TaxAug 31 2020 In North Carolina grocery items are not subject to the states statewide sales tax but are. The sales tax rate on food is 2.

Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax. Items subject to the general rate are also subject to the. While North Carolinas sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales.

The information included on this website is to be used only as a guide.

States Without Sales Tax Article

Davidson County Sales Tax Referendum Presentation

Understanding California S Sales Tax

More From County Commissioners Budget Workshop Lincoln Herald Lincolnton Nc

Tax Was Too High At Area S New Wal Mart

Is Food Taxable In North Carolina Taxjar

Exemptions From The Florida Sales Tax

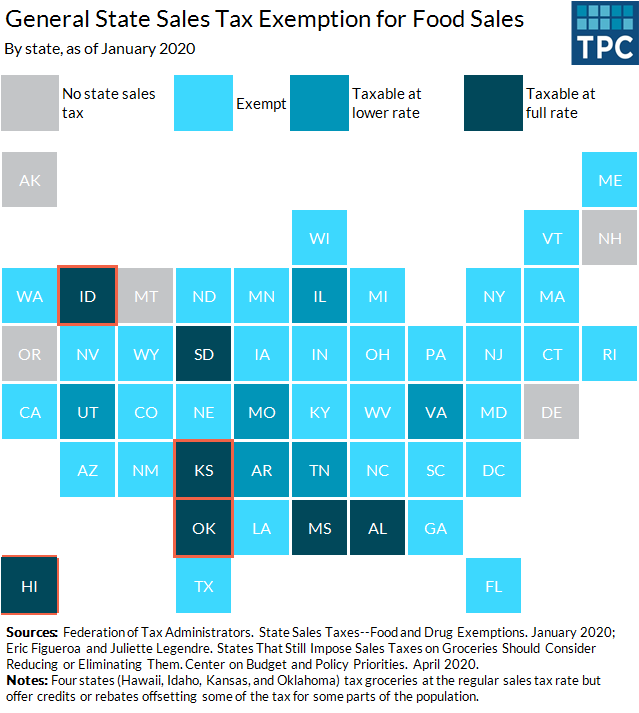

Food Sales Tax Exemption Ff 08 10 2020 Tax Policy Center

Historical North Carolina Tax Policy Information Ballotpedia

State Level Sales Taxes On Nonfood Items Food And Soft Drinks And Download Table

Texas Sales Tax Basics For Restaurants And Bars Sales Tax Helper

E 585 Fill Out Sign Online Dochub

![]()

Prepared Food Beverage Tax Wake County Government

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association

Sales Tax Laws By State Ultimate Guide For Business Owners

Is Food Taxable In North Carolina Taxjar

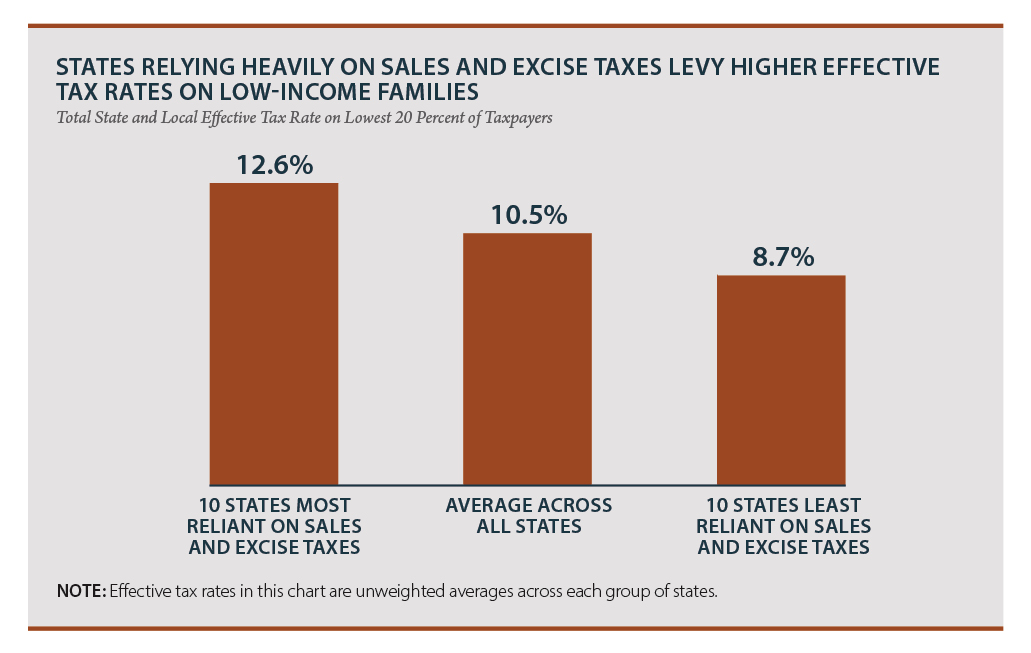

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities