how are property taxes calculated in orange county florida

Overview of Orange County CA Taxes. Last Name First Name OR II.

Estimating Florida Property Taxes For Canadians Bluehome Property Management

This equates to 1 in taxes for every 1000 in home value.

. The rates are expressed as millages ie the actual rates multiplied by 1000. The average effective property tax rate in Orange County is 069. The median property tax on a 22860000 house is 214884 in Orange County.

Property taxes are the single largest source of General Fund revenue. Property tax is calculated by multiplying the propertys assessed value by the total millage rates applicable to it and is an estimate of what an owner not benefiting from any exemptions would pay. This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on.

We want to ensure you can easily access information about the budget to determine how it will impact your family and what you pay in City property taxes. Online Property Taxes Information At Your Fingertips. Orange County calculates the property tax due based on the fair market value of the home or property in question as determined by the Orange County Property Tax Assessor.

Taxes are calculated by multiplying the property value less exemptions by the millage rate which is determined by local taxing. Beginning with the first year after you receive a homestead exemption when you purchase property in Florida an appraiser determines the propertys just value. Sec-Twn-Rng-Sub-Blk-Lot dashes optional.

The Property Appraisers Office also determines exemptions for Homestead Disability Widows Veterans and many others. The Orange County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Orange County and may establish the amount of tax due on that. The median property tax on a 22860000 house is 240030 in the United States.

407 836 5046 Phone The Orange County Tax Assessors Office is located in Orlando Florida. Office of the Clerk of the Board. The TTC shall not be responsible or liable for any losses liabilities or damages resulting from an incorrect APN Property Address Purchase Price Purchase Date andor Exemption Type.

The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties. Ad Property Taxes Info. The Property Appraisers Office also determines exemptions for Homestead Disability Widows Veterans and many others.

Orange County is the one of the most densely populated counties in the state of California. Get driving directions to this office. In Orange County higher sales prices are driving up property taxes Rates can differ widely even among neighbors for a variety of reasons To estimate their tax rate homeowners can use the.

The Treasurer-Tax Collectors Office TTC has not verified the accuracy of the APN or the property address keyed in. Post Office Box 38. With each subsequent annual assessment your.

Florida real property tax rates are implemented in millage rates which is 110 of a percent. Florida tax appraisers arrive at a propertys assessed value by deducting the Save Our Homes assessment limitations SOH from the propertys just value. Use our Tax Estimator tool to calculate your taxes especially when you are planning to Buy or Sell a property.

In Orlando Orange Countys largest city the millage rate varies from about 185 and up to more than 197 mills depending on where in the city you reside. The median property tax on a 22860000 house is 221742 in Florida. Orange County Assessors Office Services.

The General Fund of the City provides services such as police fire public works and parks and recreation facilities. The Property Appraiser determines the ownership mailing address legal description and value of property in Orange County. Each property is individually t each year and any improvements or additions made to your property may increase its appraised value.

Its also one of the richest counties in the nation. The Property Appraiser determines the ownership mailing address legal description and value of property in Orange County. Forms Download our most commonly used forms like exemption mailing address change tangible personal property and more.

Homeowners in Orange County pay a median annual property tax bill of 2073 annually in property taxes. Taxes are calculated by multiplying the property value less exemptions by the millage rate which is determined by local taxing.

Property Taxes Calculating State Differences How To Pay

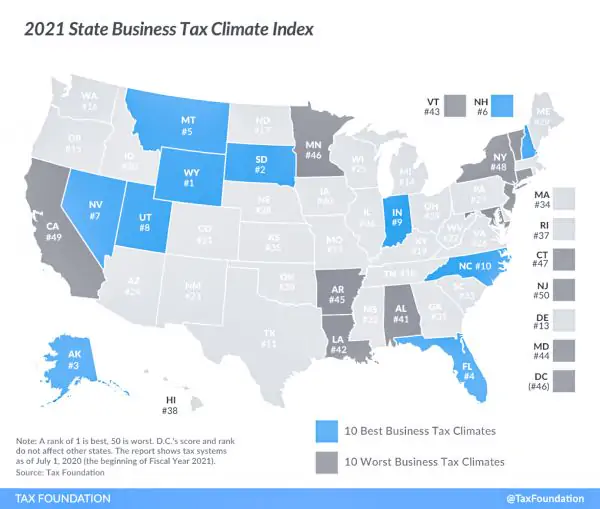

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

Property Tax Orange County Tax Collector

How School Funding S Reliance On Property Taxes Fails Children Npr

Property Tax Comparison By State How Does Your State Compare

Alameda County Ca Property Tax Calculator Smartasset

Florida Dept Of Revenue Property Tax Data Portal

What Are The Different Types Of Real Estate Property Taxes

Property Taxes By State Embrace Higher Property Taxes

Florida Property Taxes Explained

Orange County Property Tax Oc Tax Collector Tax Specialists

Florida Property Tax H R Block

Homeowners Can Save 4 On Their Property Tax Bill By Paying In November Orange County Tax Collector

Homeowners Property Taxes Grew Faster During Pandemic

The Ultimate Guide To North Carolina Property Taxes

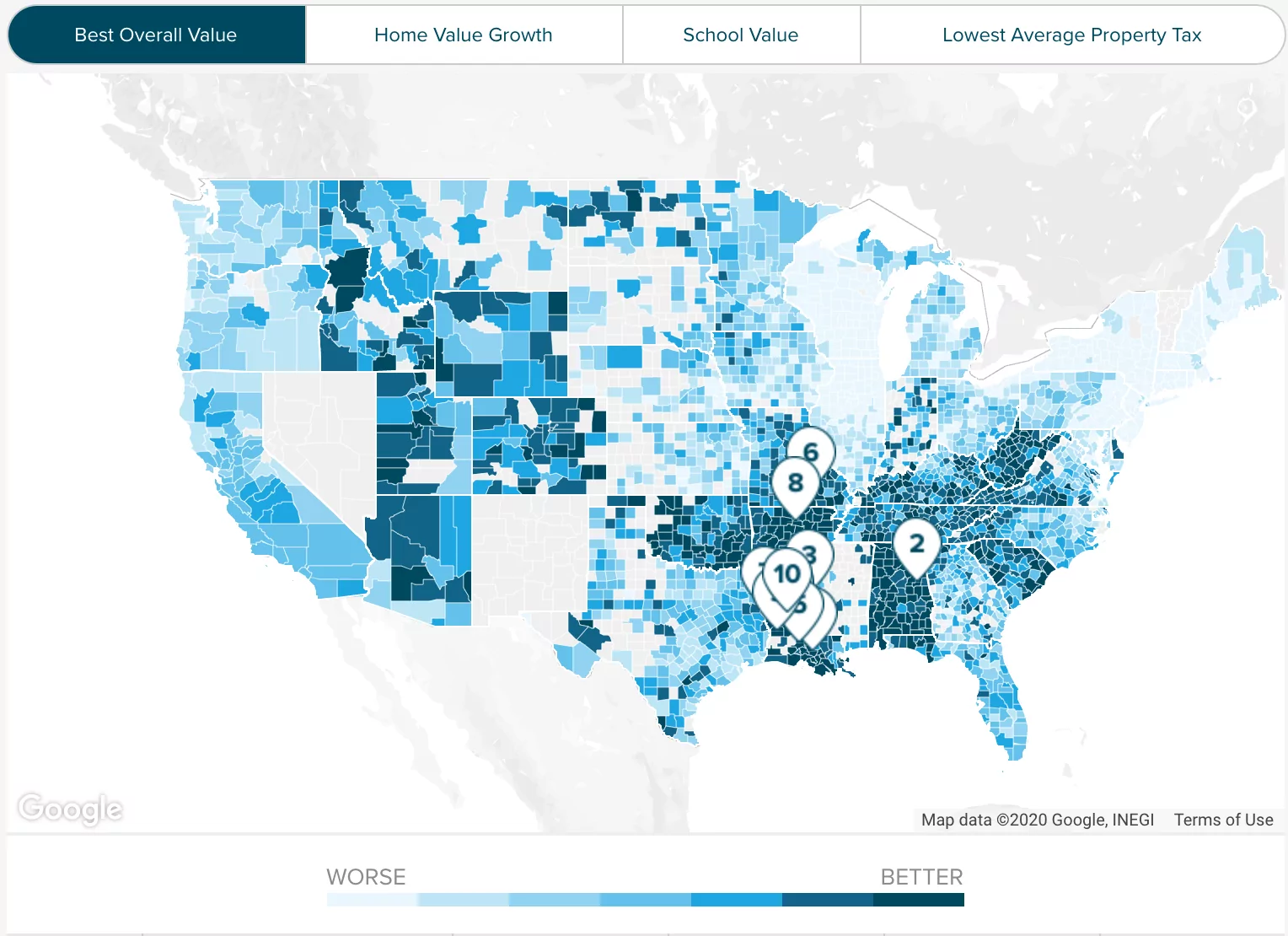

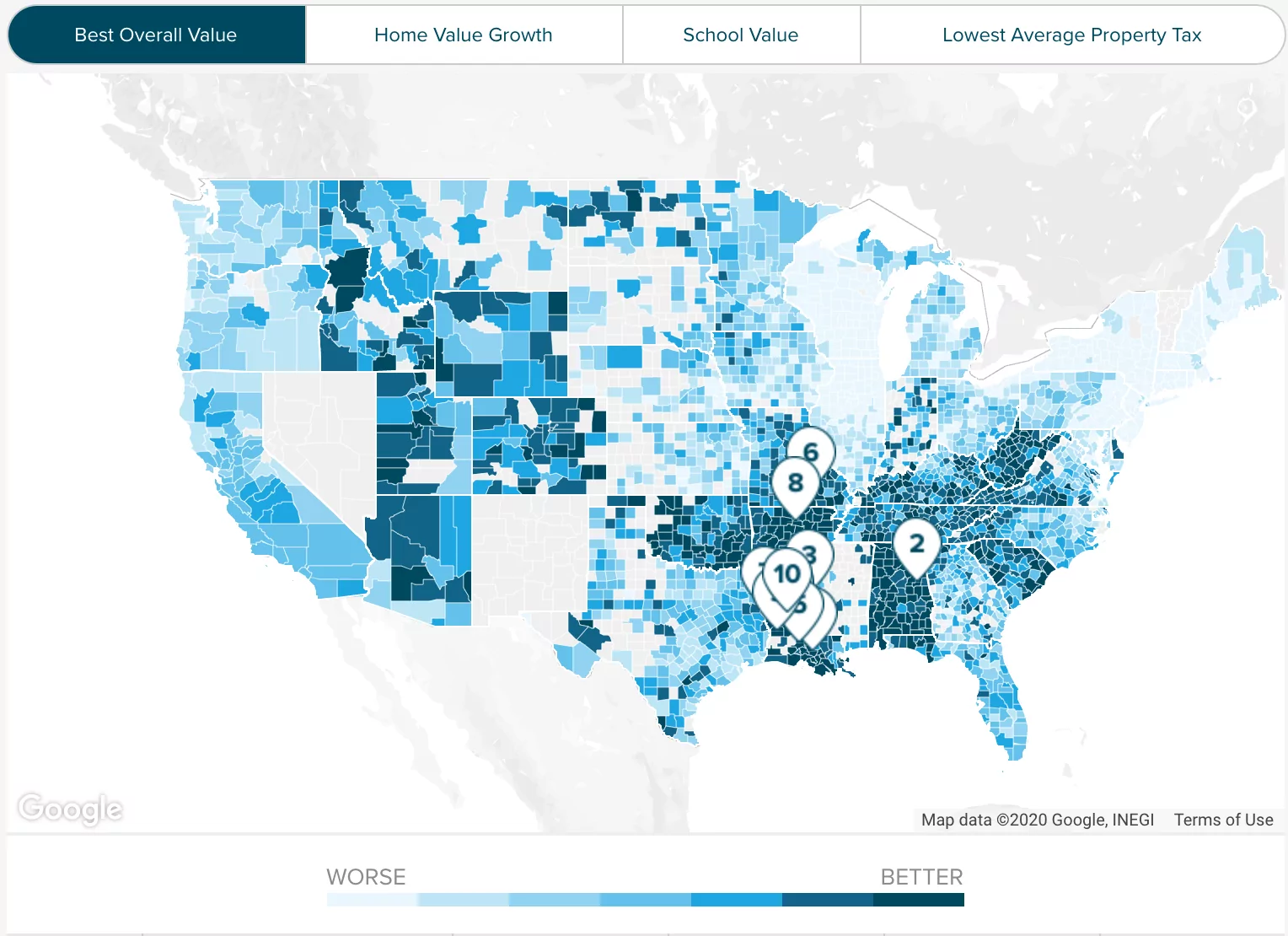

Property Taxes By State County Lowest Property Taxes In The Us Mapped